US Generic Drug Market Size, Industry Trends, Share, Growth and Report 2025-2033

United States generic drug market is expanding, driven by patent expirations, biosimilars growth, chronic disease prevalence, value‑based care.

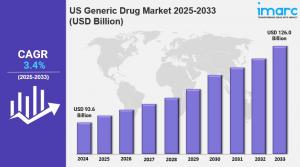

BROOKLYN, NY, UNITED STATES, July 9, 2025 /EINPresswire.com/ -- Market Overview 2025-2033The US generic drug market size reached USD 93.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 126.0 Billion by 2033, exhibiting a growth rate (CAGR) of 3.4% during 2025-2033. The market is experiencing steady expansion, driven by rising healthcare costs, patent expirations, and growing demand for affordable treatments. Key trends include increased FDA approvals, strategic mergers, and a strong focus on biosimilars and cost-effective manufacturing solutions.

Key Market Highlights:

✔️ Strong market growth driven by rising demand for affordable medications & cost containment

✔️ Surge in patent expirations boosting generic drug development

✔️ Increased FDA approvals supporting quicker market entry

✔️ Growing focus on biosimilars and specialty generics

✔️ Strategic alliances and mergers enhancing production efficiency and reach

Request for a sample copy of the report: https://www.imarcgroup.com/us-generics-market/requestsample

US Generic Drug Market Trends and Drivers:

The U.S. generic drug market is undergoing a significant transformation as the demand for cost-effective medications rises in response to increasing healthcare costs. Patients, insurers, and healthcare providers are prioritizing affordability, leading to a notable surge in the popularity of generic alternatives. With brand-name drugs often priced prohibitively high, many consumers are actively seeking generics that provide the same therapeutic benefits at a fraction of the cost. This trend is further supported by the growing emphasis on value-based care, which balances healthcare outcomes with cost considerations.

As a result, pharmacies and healthcare providers are more likely to recommend generic drugs, fostering a robust market for these medications. Government initiatives aimed at promoting generics—such as educational campaigns and incentives for prescribers—have also enhanced consumer confidence in these options. This dynamic is expected to continue, driving sustained growth in the generic sector as more patients opt for affordable treatment solutions.

The regulatory landscape surrounding the U.S. generic drug market plays a crucial role in shaping its dynamics. The FDA's rigorous approval process ensures that generics meet high standards of safety and efficacy, which builds trust among consumers and healthcare professionals. However, the complexity and length of the approval process can pose challenges for new entrants looking to capture market share. As patent expirations for brand-name drugs increase, numerous opportunities arise for generic manufacturers to enter the market.

The Hatch-Waxman Act has facilitated this process by allowing abbreviated new drug applications (ANDAs), streamlining the approval process for generics. Nonetheless, the market is also experiencing heightened scrutiny regarding manufacturing practices and quality control, prompting companies to invest in compliance and operational excellence. This regulatory environment not only affects the speed at which generics can enter the market but also influences pricing strategies, as companies must balance compliance costs with competitive pricing to attract consumers.

Technological advancements are significantly reshaping the U.S. generic drug market, driving innovation in drug formulation and manufacturing processes. The integration of advanced technologies, such as artificial intelligence (AI) and machine learning, enhances the efficiency of drug development and production. These technologies enable manufacturers to optimize formulations, reduce production costs, and improve quality control measures. Additionally, the rise of digital health solutions and telemedicine is changing how consumers access medications, making it easier for them to obtain prescriptions for generics.

As patients become more tech-savvy, they are increasingly likely to research and request generic options, further fueling market demand. Ongoing investments in research and development by generic manufacturers are also leading to the introduction of complex generics that cater to specialized therapeutic areas. This trend toward innovation is expected to enhance the competitive landscape of the generic drug market, allowing companies to differentiate themselves and capture a larger market share.

The U.S. generic drug market is poised for continued growth, driven by several key trends reflecting evolving consumer behavior and healthcare dynamics. As the demand for affordable medications escalates, the market is witnessing a surge in generic drug approvals, particularly as numerous blockbuster drugs approach patent expiration. By 2025, a significant number of brand-name drugs will lose patent protection, creating lucrative opportunities for generic manufacturers to introduce alternatives.

Moreover, the increasing prevalence of chronic diseases and an aging population are contributing to higher medication consumption, further propelling the demand for generics. The market is also experiencing a shift toward online pharmacies and mail-order services, which facilitate easier access to generic medications for consumers. Additionally, collaborations between generic manufacturers and healthcare providers are becoming more common, as they aim to enhance patient adherence to treatment regimens through cost-effective options. Overall, the U.S. generic drug market is adapting to changing healthcare needs, positioning itself for sustained growth in the coming years.

Checkout Now: https://www.imarcgroup.com/checkout?id=567&method=1190

US Generic Drug Market Segmentation:

The report segments the market based on product type, distribution channel, and region:

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Segment:

• Unbranded

• Branded

Breakup by Therapy Area:

• CNS

• Cardiovascular

• Dermatology

• Genitourinary/Hormonal

• Respiratory

• Rheumatology

• Diabetes

• Oncology

• Others

Breakup by Drug Delivery:

• Oral

• Injectables

• Dermal/Topical

• Inhalers

Breakup by Distribution Channel:

• Hospital Pharmacies

• Retail Pharmacies

Breakup by Region:

• Northeast

• Midwest

• South

• West

Ask Analyst & Browse full report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=567&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Elena Anderson

IMARC Services Private Limited

+1 631-791-1145

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.